Develop a finance app to simplify the process of keeping track of spending and generate strategic reports.

A personal finance app is useful for all and there are a high number of smartphone users, making it the ideal app to develop for the current market. Hire experts to develop it using Laravel for the backend.

Introduction

What is a Finance App?

Benefits of Finance App Development?

Key Features

How to Make Money?

Tips to Develop a Finance App

Common Challenges For Finance App Development

Tech Stack and Development Team

Cost of Development

Our Expertise

Conclusion

FAQ

Introduction

Managing one’s finances can be a nightmare, and without any decent system in place, like a dedicated software or offline system at hand, it can be hard to make head or tail of it. It can be worse for those who find it hard to figure out what they are spending it on. Good software can help one analyze the spending and provide a detailed report as well.

A finance app can do many more than that; it can store all your bank cards and bank account information and help organize your finances. It is the ideal method to gain more control over your spending, save money, and avoid getting into debt. This article provides more information on finance app development using Laravel.

What is a Finance App?

A personal finance app, as the name suggests, is an app that is specially built to manage your finances. It is an app that can help organize your spending and calculate expenses and earnings based on custom categories. It can be useful to generate several customized reports and help visualize the spending. It is ideal for someone looking to find funds to allocate toward saving.

Benefits of Finance App Development?

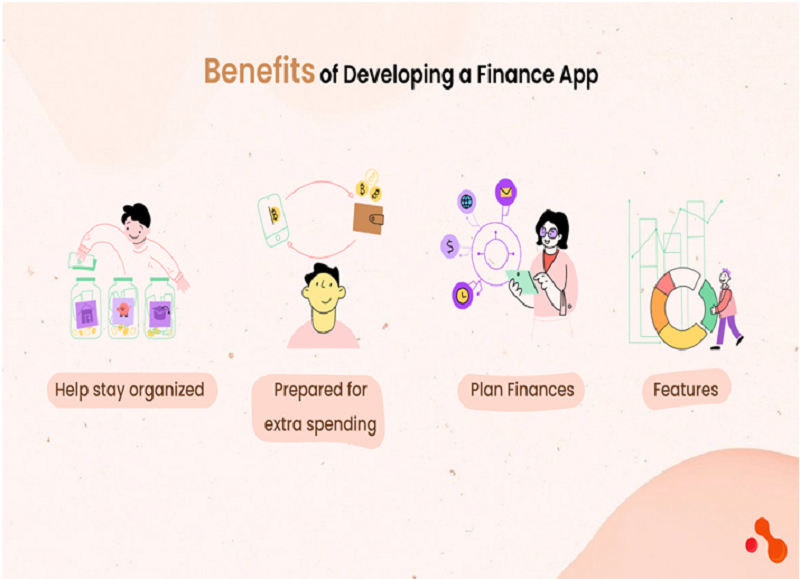

There are many benefits of developing a personal finance app:

- It helps one stay organized and predict future expenses.

- One can be more prepared for extra spending as well.

- It provides users with several features that allow them to visualize their spending using graphs, reports, etc.

- This is the ideal tool for those who create their budgets in advance and like to plan their finances.

Several statistics suggest the same:

- 73% of smartphone users have an app to manage their finances.

- There were 1.3 Billion downloads of personal finance apps in the second quarter of

- Penetration of the smartphone in the USA in 2020 was 81,6%

- A global survey suggests that over 75% of smartphone users use a mobile app to manage their finances.

Key Features

- User account: The user can create an account, log in, and keep their data secure with the help of a strong authorization system.

- Tracking: Users can track both their spending and earnings. They can also use smart filters to find the data for a specific time period.

- Profile: Users can manage their profiles and set their preferences.

- Categories: Users can organize their earnings and expenses in various categories.

- Notifications: Provide users with useful notifications like upcoming spending, bills, and earnings.

- Goals: Users can set their goals for saving, earning, and also for each individual category.

- Linking: Users can link their app to official banking accounts and payment services to synchronize and update the data.

- SMS reading: Users can allow the apps to read transactional SMS messages to update the app data for expenses and earnings.

- Tools: The app will provide additional features like an in-built calculator, currency converter, etc.

How to Make Money?

There are many ways to monetize an app like this. Some of the popular methods are:

- The app can be designed to force customers to pay either a monthly or yearly subscription to use the premium services of the app.

- The app can have a trial period when it is free, and then need for the users to opt for one of the subscription plans in order to use it.

- Advertising within the app is another way to monetize it. Users who wish to have an ad-free experience need to pay for the service.

Tips to Develop a Finance App

- Consider the type of features and experience the average user expects prior to designing the app.

- Research and brainstorm regarding finance apps and also take a look at the competitor apps.

- There are already many finance apps out there; hence it is a good idea to add some unique features to give your app the upper edge.

- Avoid making the app interface too complicated since this will only confuse the average user. Users need an app that is simple to use, has a simple interface, and allows them to log their data, generate reports, and perform analysis.

- An app like this consists of sensitive information on the user as well as their financial details; hence it is essential it is designed to be secure.

- It is a good idea to include additional features like tips for spending, smart budgeting features, and automation.

- There are many types of apps one can develop, like a simple finance app or a complex finance app.

- AI algorithms can be used to help personalize the experience of the users and to make the process of using the apps smoother and effortless.

- Integrating good customer support with the help of AI chatbots can help users who tend to have tons of questions.

Common Challenges For Finance App Development

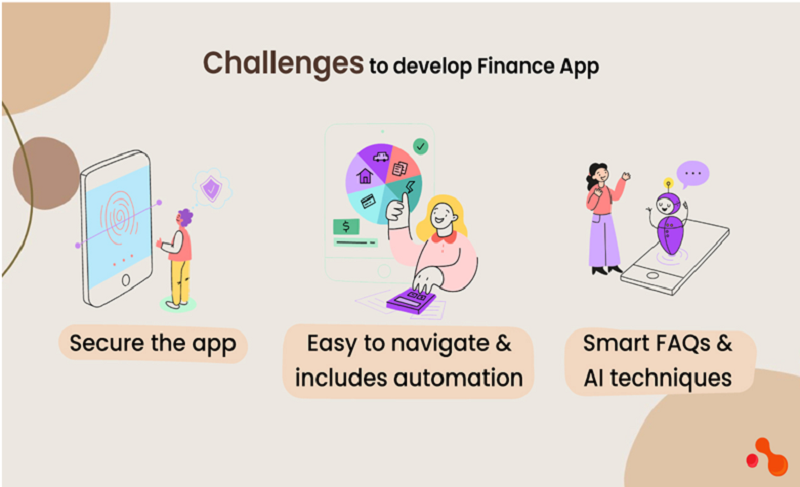

- A financial app is bound to have sensitive information about the user’s finances; it can also have details about their credit cards and other types of cards and bank accounts. One of the biggest challenges is to secure the app to ensure the user account is not hacked and data is not stolen.

- This is an app that users may need to use only on a daily basis based on their preferences. Users tend to avoid using apps that are too complicated and will search for alternative solutions if that is the case. It is vital the app is easy to navigate and includes automation.

- Users tend to have lots of questions and do not like to wait for the answers. Including smart FAQs and using AI techniques can help address this issue.

Tech Stack and Development Team

Conducting your research to get the perfect list of features is a hard task. Selecting the technologies suitable to develop your mobile application is easier. However, it is a good idea to consult the experts like those at Acquaint Softtech to find the best possible technologies.

For example, Laravel is one of the best options when it comes to developing the backend. It is a highly secure PHP framework with a secure authentication system built-in. This is a tried and tested solution with several libraries and reusable code to reduce the risk. The tech stack to develop such an app is extensive and looks like this:

HTML, CSS, JavaScript, React.JS, Vue.JS, Firebase, MySQL, AWS, Google Cloud, AI solution integration.

Acquaint Softtech has the ideal team to develop such an application and offers Laravel development services. The ideal team to develop a finance app would consist of the following:

- Project Manager

- Backend Developer

- Mobile app Developer

- QA Tester

Cost of Development

The cost of developing a personal finance app depends on various factors, besides the fact that the more factors, the more time it might take and the more it will cost. However, there are several other factors that will influence the cost of developing this app. Some of the other factors are listed here:

- The development firm you select also affects the cost, especially the location of the development firm.

- Using an in-house team is bound to cost more than outsourcing it to a professional mobile app development company.

- Hiring freelancers can work out less expensive; however, a professional mobile app development company is more reliable like Acquaint Softtech.

- There are multiple options when it comes to selecting a development plan. Some of the common plans include hiring dedicated developers on a full-time basis, hiring part-time developers, and hiring a development firm on a fixed project cost basis.

Our Expertise

Acquaint Softtech has a highly experienced team of mobile app developers and all the resources necessary to develop a personal finance app. We have extensive experience doing so as a mobile app development company. Our team of developers, designers, testers, and project managers and a growing client base with only good reviews from our previous clients.

Conclusion

It makes perfect sense for one to invest in the development of a personal finance app or Fintech app development at this time. This is a time when the use of smartphones is on the rise, with no signs of this trend expected to change in the near future. Creating a feature-rich app that allows users to manage their finances will be in high demand in the future as well.

It is advisable to hire a developer from Acquaint Softtech to create a stunning app and add a few unique features to make it stand out.

FAQ

1. What is a finance app?

This is an app that can transform your smartphone into your money manager. This type of app is ideal to track spending and earnings, generate reports and synchronize all accounts like a bank, credit, debit, etc.

2. What are the benefits of developing a personal finance app?

I can help one manage their finances from the palm of their hands and integrate all the accounts in a single app. It is simpler to generate reports and analyze the spending as well.